Contents

- The scale of the problem why is protection necessary?

- Most common methods used by fraudsters

- Cyber Fraud Detection (CFD) Platform

- Why is this so important?

- Summary

Cybercrime is

becoming one of the biggest challenges of today’s financial sector.

The number of online fraud attempts and attacks is growing year by

year, affecting both individual customers and businesses. In this

reality, it is crucial not only to be aware of the risks, but above

all to have effective protection tools.

The Polish credit bureau (BIK) has for years been supporting banks, lending institutions and leasing companies in their fight against fraud, providing innovative technology solutions. Three of them the Antifraud Platform, the Cyber Fraud Detection Platform, and the Behavioural Verification Platform significantly enhance transaction security and help protect the funds of millions of Poles.

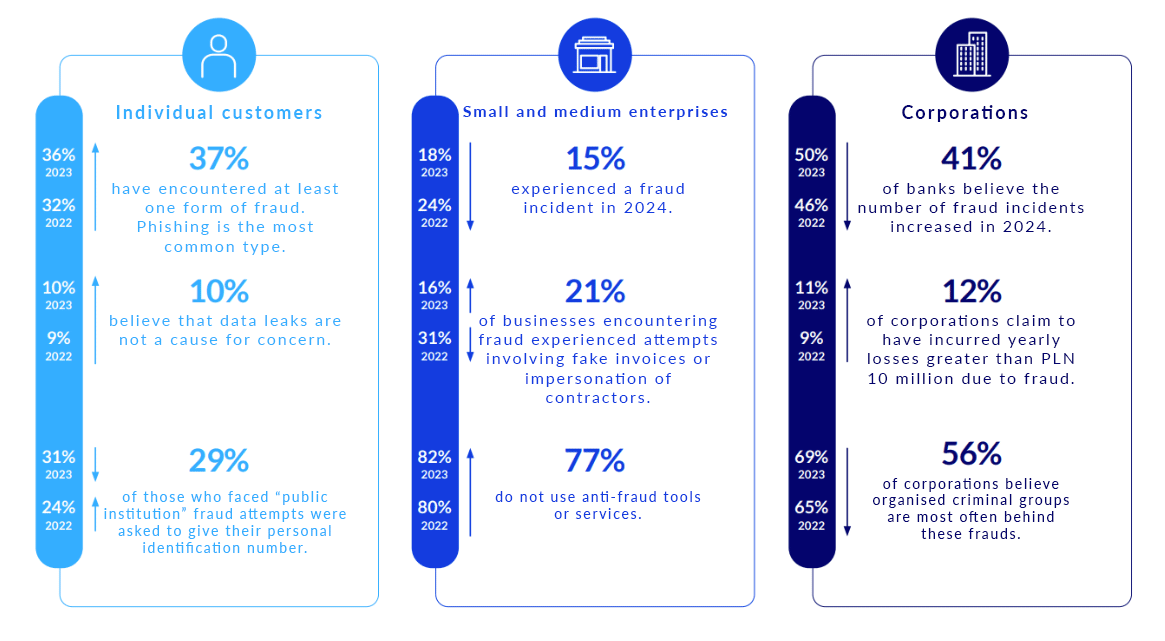

The scale of the problem why is protection necessary?

BIK’s antifraud report makes it clear that financial fraud in Poland is steadily increasing and taking on more and more complex forms. In 2023, financial institutions had to contend with thousands of fraud attempts, and the losses could have potentially reached hundreds of millions of zlotys. Importantly, criminals today operate on multiple fronts both in traditional credit and loan processes and in online channels, using stolen login details, impersonating institutions, or taking control of customers’ devices.

Scale of frauds.

The data from BIK leaves no room for doubt:

- Every day in Poland, attempts are made to fraudulently obtain loans and credit for significant amounts.

- In the area of credit products for individuals alone, the number of intercepted fraud attempts is growing.

- Businesses are also increasingly targeted by cybercriminals, especially in the areas of leasing and factoring.

Most common methods used by fraudsters

Criminals today use an extensive arsenal of social-engineering and technological techniques. The most common include:

- Phishing fake emails or text messages impersonating banks or public offices, designed to steal login credentials.

- Identity theft using stolen personal data to take out loans or credit.

- Online account takeover for example, by tricking a customer into installing remote-desktop software, which gives criminals full control of their device.

Basic methods of fraud

Anti-fraud Platform (PAF)

One of the biggest threats to the financial sector remains the fraudulent taking out of loans and credit using someone else’s identity. It was precisely with the protection of financial institutions and their customers in mind that BIK, the Polish credit bureau, established its Anti-fraud Platform (PAF) a tool that analyses data in real time and enables suspicious applications to be intercepted before funds are released.

PAF uses a set of anti-fraud rules that verify parameters such as:

- consistency of identity data

- contact details

- employment information and sources of income

Thanks to the above, financial institutions can identify situations in which a customer is attempting to take out a loan using stolen personal data.

Effectiveness confirmed in numbers:

- Since 2017, PAF has enabled financial institutions to save over PLN 930 million, by preventing fraud involving loan and credit products for individuals.

- Since 2020, the system has blocked fraud worth over PLN 146 million in financial products for businesses. (Data as of the end of May 2024)

Practical example

Let’s imagine a situation where someone submits an application for a cash loan using stolen personal data. Usually the verification process might not detect this fact. But PAF, by analysing detailed information about the customer, spots inconsistencies for example, no confirmation of employment or suspicious contact details and halts the application before the bank disburses the funds.

Benefit: the institution protects its finances and reputation, and the customer whose data was stolen does not have to later prove that they did not take out the loan.

Cyber Fraud Detection (CFD) Platform

An ever greater share of financial activity is shifting online, meaning that the number of attacks aimed directly at online and mobile banking is also increasing. One of the most dangerous scenarios is when a criminal steals a customer’s login credentials and attempts to make an unauthorised transfer or withdrawal of funds.

The Cyber Fraud Detection (CFD) Platform, BIK’s advanced analytical tool, protects against exactly these kinds of threats.

CFD works by analysing a broad spectrum of transactional and technical data. The system is capable of:

- detecting suspicious logins for example when access to an account is gained from an unusual device or location

- identifying compromised accounts situations where someone attempts to carry out operations on an account while pretending to be the customer

- halting a transaction in real time by reacting quickly and blocking the transfer or withdrawal before the money leaves the account

An additional strength of CFD is the ability for financial institutions to exchange information with one another across the sector about devices that may be being used for illegal activities.

Practical example

A customer logs in to their account from a new mobile device. The system detects that suspicious transactions were previously attempted from the same smartphone at another financial institution. CFD immediately raises the alarm, and the bank, having this information, can withhold the transfer and verify the user’s identity before any funds are lost.

Benefit: protection of the customer’s money and minimisation of the risk of loss for the bank.

Behavioural Verification Platform

One of the most advanced ways of protecting against fraud is the use of what is known as behavioural biometrics, meaning the analysis of how a user interacts with their device. This is exactly how the Behavioural Verification Platform developed by BIK works.

The system, based on machine-learning mechanisms, observes the user’s characteristic patterns of behaviour, including:

- the speed and rhythm of typing on the keyboard

- how the mouse is used

- gestures performed on the smartphone screen

Thanks to these analyses, the platform is able to distinguish between the real account owner and someone who has stolen their login credentials.

Why is this so important?

Criminals are increasingly often using methods persuading customers to install remote desktop software, allowing them to gain control of the device. From the banking system’s perspective, it then appears to be the usual activity of the user but behavioural analysis makes it possible to detect that “something is wrong”.

Practical example

A customer regularly uses the bank app on their smartphone; the system “knows” their way of logging in and making transfers. At some point, a fraudster who has stolen the user’s access details logs in to the account, and begins carrying out operations via a remote desktop. The Behavioural Verification Platform immediately detects the unusual behaviour and informs the financial institution, which can block the transaction and secure the funds.

Benefit: even faster halting of fraud attempts that would not be caught by standard security procedures.

Summary

The scale of financial fraud in Poland is growing, and cybercriminals’ methods are becoming increasingly advanced. In this situation, the protection of customers and institutions requires not only vigilance, but above all the use of modern anti-fraud technology.

BIK, the Polish credit information bureau, has been supporting the financial sector for years, providing tools that significantly increase market security:

- Anti-fraud Platform (PAF) which stops fraudulent loans

- Cyber Fraud Detection (CFD) Platform which protects online transactions

- Behavioural Verification Platform which detects unauthorised activity before losses occur

Together, they form a comprehensive shield that protects both individual customers and businesses, minimising the risk of financial losses and enhancing trust in financial institutions.

For more information on how BIK supports the financial sector in combating cyberthreats:

- download BIK’s latest Anti-fraud Report for detailed information on the scale of the problem

- contact BIK’s experts to check how our tools can support your institution

Together, we can

effectively protect the financial market and the security of millions

of customers.