Contents

- What is family fraud?

- Types of family fraud

- Deliberate and unintentional forms of family fraud

- Deliberate fraud

- Unintentional fraud

- Who commits family fraud most often?

- What are the consequences of family fraud?

- How does technology help detect family fraud? (CFD by BIK)

- How to prevent family fraud

- Summary

- Frequently asked questions

Financial fraud is

most often associated with actions taken by strangers cybercriminals impersonating bank employees, scammers phishing for

data, or organised groups operating online. Yet, more and more often,

the greatest threat comes not from hackers or external fraudsters,

but from people closest to us.

So-called family fraud is a particular form of malpractice in which the perpetrator is a family member somebody with access to personal data, devices, logins, and communication channels. The mechanism can vary: from an accidental purchase by a child to the deliberate taking out of a loan in a senior’s name. In all cases, however, we are talking about the unauthorised use of someone’s identity or personal data.

From the perspective of financial systems and identity protection, such incidents are among the most difficult to detect and the most sensitive, as they combine technological and emotional aspects. Nevertheless, effective fraud prevention must also address cases where the fraud is based not on technology but on relationships and the abuse of trust.

What is family fraud?

Family fraud is a form of deception in which the perpetrator is somebody close to the victim, and most often a family member. We speak of such fraud when a family member’s personal data, funds or identity are used without their knowledge or consent.

Unlike in classic cases of identity theft, family fraud does not need security measures to be broken. The perpetrator frequently knows the victim’s personal data and has access to their devices, bank accounts, credit cards, documents and passwords. As such, transaction systems may perceive the wrongdoer’s actions as authorised.

There are various forms that family fraud can take from a one-off and seemingly trivial online purchase by a child using a parent’s bank card to more complex cases such as taking out a loan, buying goods via hire purchase, or impersonation in order to obtain other financial benefits.

Despite such practices occurring within the family, their consequences are just as serious as in the case of fraud committed by strangers both financially and legally. Furthermore, from the perspective of the financial institution, who committed the fraud is irrelevant; what matters is that security procedures were breached, which can lead to losses, chargebacks, and an escalation of operational risk.

Types of family fraud

Family fraud is not uniform. It can take on various guises, depending on the wrongdoer’s intentions, their relationship with the victim, and the type of personal data used. There are several typical scenarios that we can distinguish in practice.

Online purchases made by children

The most common type of family fraud is where a child or teenager uses a parent’s payment card to buy games or subscriptions, or to place online orders. Sometimes this is done unknowingly, and sometimes with full awareness. Regardless of the motive, this still constitutes unauthorised use of funds.

Taking out financial commitments

This is a more serious case, where a family member uses the personal data of somebody close to them, most often a senior citizen, to enter into a loan, leasing, hire-purchase or other financial agreement. It is common for the perpetrator to alter the contact details so that the victim does not receive information about the debt.

Impersonation in deferred-purchase schemes (BNPL)

Due to their growing popularity, Buy Now, Pay Later (BNPL) systems are particularly susceptible to family fraud. All it takes is access to somebody’s personal data and email address to make a purchase at their expense, usually without their knowledge.

Taking control of a bank account or shopping profile

A family member may gain access to a person’s bank account, e-commerce platform or financial app by using saved passwords or shared devices. They can then initiate bank transfers, adjust limits, order goods, or withdraw funds.

Seniors as “silent victims”

Older adults often unwittingly share their personal data with loved ones whether out of trust, ignorance, or as a result of manipulation. This information is sometimes used to take out loans or order goods. Even when such incidents come to light, seniors rarely report them most often because they wish to protect their loved ones. It is also sometimes the case that, for a long time, they remain unaware of having been defrauded.

Deliberate and unintentional forms of family fraud

Not all cases of family fraud are alike. Some are intentional and planned, while others are the result of a lack of awareness or understanding of what such actions may entail. Although the financial consequences can be similar, the wrongdoer’s intention matters including for how both the victim and the financial institution assess the situation.

Deliberate fraud

This refers to situations in which a family member knowingly uses the personal data of a loved one to obtain financial gain. Such actions are usually planned, and the perpetrator takes steps to conceal their identity and keep the operation secret from the victim.

Typical cases:

- using a loved one’s personal data to take out a loan or buy goods via hire purchase

- using access to a joint account without authorisation

- providing one’s own contact details for a transaction carried out using somebody else’s personal data, in order to keep the operation secret

Unintentional fraud

This type mainly involves children or other young family members using the personal data of a parent or guardian without understanding the consequences of their actions. For example, with access to a parent’s telephone, they can make online purchases, subscribe to services, or carry out micropayments in games often accidentally or in the belief that this has no consequences.

Typical cases:

- using a stored payment card to purchase a game or app

- registering on a website or activating a paid service without the account owner’s knowledge

- unknowingly accepting terms of payment on a parent’s phone

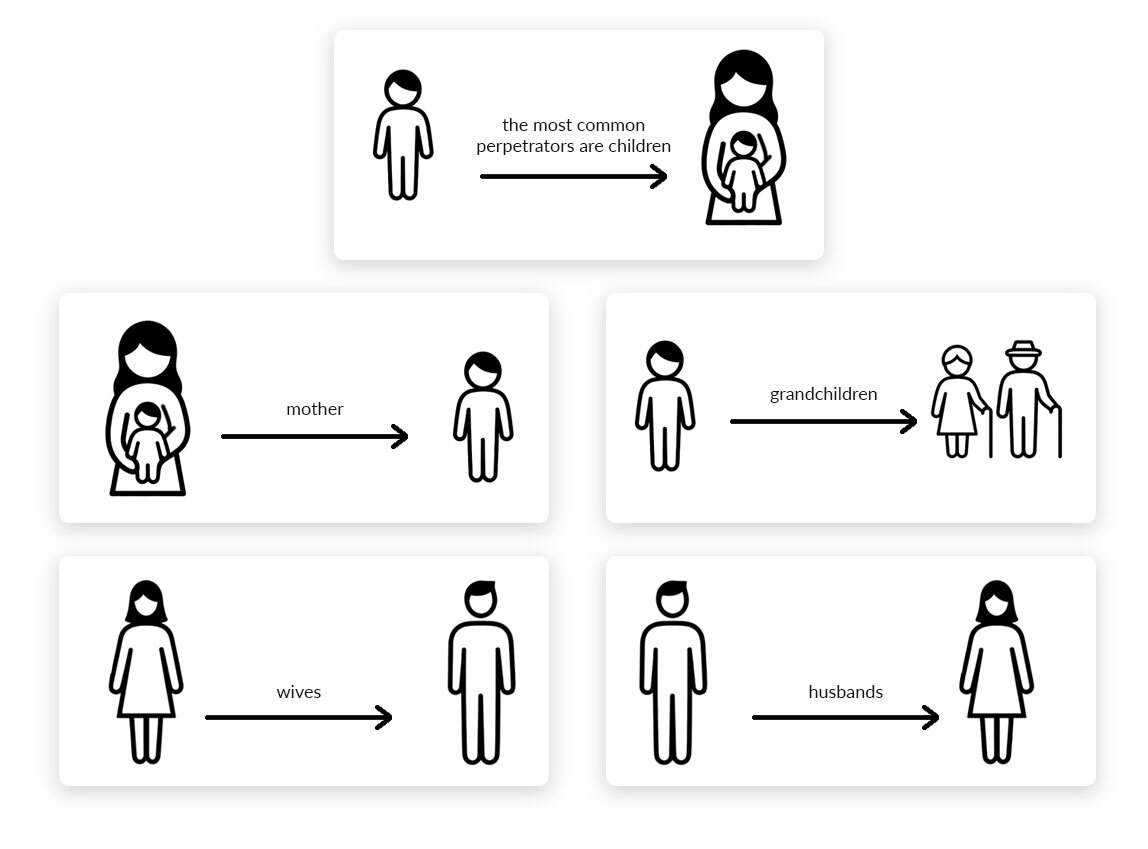

Who commits family fraud most often?

Family fraud has its own distinct characteristics and not only due to the closeness of the relationships involved, but also because of the recurring patterns that can be observed in case analyses. Although situations differ, certain roles reoccur more often than others.

Children and teenagers

These are the most common perpetrators, especially in cases of unauthorised online purchases. Children often use their parents’ cards to pay for subscriptions, games, or in-app purchases, sometimes without fully understanding the consequences, and sometimes acting with intent.

Partners and spouses

There are occasions when one partner takes on a liability or uses the other’s personal data without the latter’s knowledge. This applies both to current relationships and to former ones where access to data has remained unchanged. It is particularly common for such cases to involve joint accounts or loans.

Parents or guardians

In some cases, adults use their children’s personal data, for example to avoid a negative credit record or to take out a loan. Although such situations are less common, they have serious legal and ethical consequences.

Grandchildren and more distant relatives

Elderly family members are often exploited by younger ones by grandchildren, nephews, nieces, or cousins who gain access to their personal data and then apply for hire purchase agreements or loans. They conceal such transactions from the victim by changing the contact details.

Why is family fraud so difficult to detect and prevent?

Family fraud is one of the most insidious forms of fraud, not because it is technologically advanced, but because it is built on trust. The perpetrator does not need to break through any security measures, since they often simply know the data required.

- Access

to data and devices

Family members have natural access to personal data, payment cards, personal identification numbers, mobile devices and passwords. They may well know the answers to security questions, use the same computers, and log in from the same IP addresses. - No

suspicion on the part of the victim

Victims are often unaware of anything being wrong either because they trust their loved ones, or because they do not realise that they have fallen victim to fraud. In many cases, the first sign is a demand for payment or notification of a record in the BIK credit information bureau. - Low

rate of reporting

Unlike with classic cases, family fraud is rarely reported to the authorities. Victims fear the consequences for the perpetrator or feel partly responsible for what happened. There are also occasions when they attempt to resolve the matter amicably.

What are the consequences of family fraud?

Despite often remaining in the shadow of other types of fraud, family fraud entails serious consequences for the wronged person and for the financial institution or seller involved. The practice strains family relationships, but also affects credit systems, debt recovery processes, and brand reputation.

For the victim:

- deterioration of credit history and appearance on debtor lists

- liability for debts they did not incur

- account freezes and restricted future access to finance

- stress, family tension, feelings of guilt or shame

For the seller or financial institution:

- loss of goods or funds as a result of chargebacks

- increased costs of handling complaints

- risk of reputational damage and loss of customer trust

- the need to reinforce verification processes

How does technology help detect family fraud? (CFD by BIK)

In family fraud cases, classic authentication mechanisms and transaction-history analysis frequently prove insufficient. From the system’s perspective, everything looks right: transactions are made from the correct device, logins take place from a usual location, and the data matches. It therefore becomes crucial to detect subtle signals that may indicate abuse. And this is precisely what CFD the Cyber Fraud Detection Platform is for.

- Anti-fraud

rules engine

CFD operates on the basis of a set of rules that analyse a device’s technical data and contextual data. This makes it possible to detect unusual connections characteristic of family fraud. - Multiplicity

rules

One of the most effective mechanisms is that of the so-called “multiplicity rules”. These enable the detection of situations where, for example, the same personal identification umber appears in several different applications, but with different forenames, surnames, email addresses and telephone numbers. This is a typical family-fraud pattern, for example a grandson submitting an application using his grandmother’s data but providing his own contact number. - Additional

verification by

telephone

Some subscribers opt for additional contact with the customer, for example by telephone call. Such contact can help confirm the user’s identity, especially when there are doubts as to whether the data matches the caller’s behaviour or style of communication. In the event of any uncertainty, additional verification steps are taken.

Early detection is particularly important in family fraud, as victims rarely report such incidents themselves.

How to prevent family fraud

Family fraud is difficult to detect and is often reported with a delay, which is why prevention is crucial. Both individual customers and financial institutions or retailers can implement specific measures to reduce risk.

For customers:

- no sharing of personal data, logins, or passwords not even with loved ones

- using biometrics, PINs or passwords to protect devices and apps

- using BIK alerts and systems for blocking personal identification numbers

- talking to family members about the risks of using other people’s data or funds without their consent

For retailers and financial institutions:

- implementation of two-factor authentication (2FA)

- automatic SMS or email notification after an order or application is placed

- analysis of patterns of unusual behaviour and contact details

- using antifraud tools such as the CFD Platform, which detect patterns typical of family fraud

Summary

Family fraud is a real and growing threat. It is hard to detect, since it takes place within close relationships and often goes unnoticed. However, even unintentional actions can have serious legal and financial consequences, which is why technological tools capable of recognising unusual patterns are so important, as is education to increase risk awareness. In a world where family trust can be exploited, the only effective solution is a combination of prevention, technology, and openness to discussion.

Frequently asked questions

Is family fraud a crime?

Yes even if the perpetrator is someone close, the unauthorised use of another’s personal data or funds is still a violation of the law.

Can I report a fraud if I don’t want my loved one to get into trouble?

You can seek mediation or legal advice, but if you want to protect your credit history or avoid debt, reporting is often essential.

How can I recover money in the event of family fraud?

In many cases it is possible to file a complaint, especially if the transactions were unauthorised. Much depends on the policy of the institution concerned and how quickly you react.

Can I be held liable for debts that I did not incur?

Yes if you fail to report the matter promptly or do not block your personal data, institutions may assume the transactions were authorised.

How can I protect myself against unintentional fraud by a child?

Set up device locks, restrict access to payment cards, enable transaction authorisation, and talk to your child about financial responsibility.

Do tools such as CFD only detect family fraud?

No CFD analyses various types of abuse, but thanks to multiplicity rules and connection pattern analysis, it is particularly effective at recognising patterns typical of family fraud.