Contents

- What is behavioural verification?

- How does behavioural verification work in practice?

- Behavioural verification in online banking and mobile apps

- Effectiveness and benefits for customers

- Behavioural verification as part of the BIK ecosystem

- Behavioural verification and the future of security measures

- Summary

Security in online

banking and mobile apps today requires measures that provide real

protection for bank accounts and confidential data, while

simultaneously maintaining the comfort of using the services.

Behavioural verification is a modern form of protection, invisible to

the user, that analyses how the user interacts with a given device.

Thanks to this tool, banks are able to sooner detect unusual patterns

and react to threats before fraudulent transactions are carried out.

The user logs in and performs operations “as always”, while in

the background the system checks the consistency of their behaviour

with their user profile, thereby raising the level of security.

What is behavioural verification?

Behavioural

verification is technology that confirms the user’s identity, not

on the basis of biometric data such as a fingerprint or face scan,

but by analysing their behaviour when using the device.

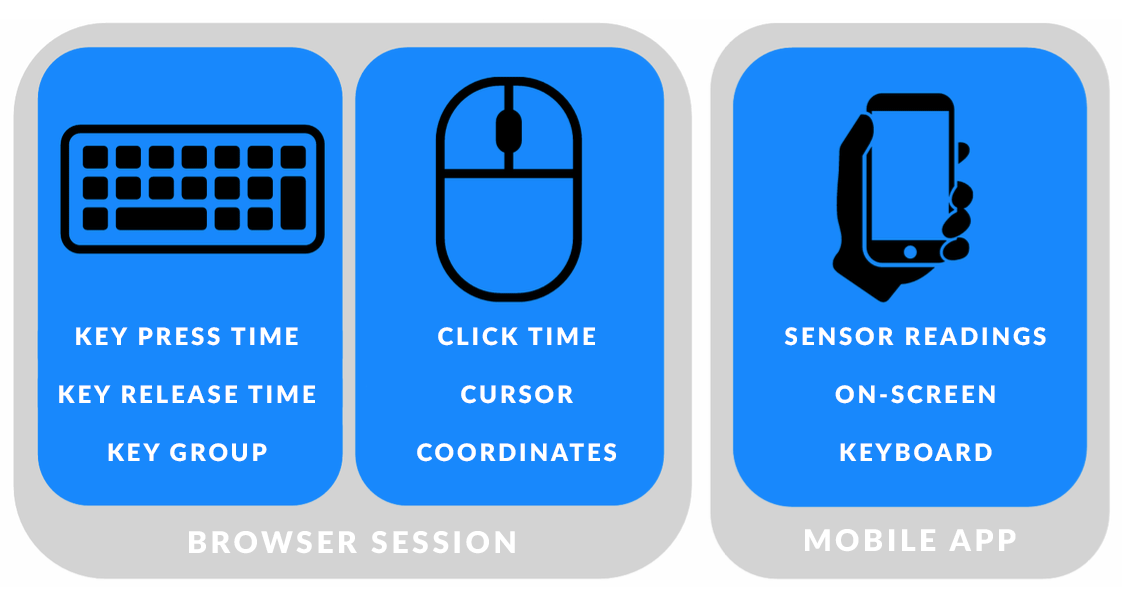

Every one of us has a distinctive way of using a computer, smartphone or tablet. The system therefore creates a behavioural profile in which the following, among other things, are recorded:

● rhythm and speed of typing on the keyboard, and how specific keys are pressed

● characteristic gestures on a touchscreen

● how the cursor is moved, and how the mouse is used

● typical sequences of actions when using apps or websites

Such a behaviour profile is unique and hard to fake. The user’s behaviour during every online-banking session and every use of the mobile app is compared with their earlier patterns. The result of this analysis is presented as a so-called SCORE a measure of how closely the current activity aligns consistency with the recorded profile. This allows the system to verify, in the background, whether the account is being used by its owner or by an unauthorised party.

How does behavioural verification work in practice?

During logging in and the performing of operations, the system analyses how the device is used and checks whether this matches the previously recorded patterns. For the user, the entire process goes unnoticed; they simply use their banking service as usual, while the technology monitors whether everything is consistent with the user’s unique behavioural pattern.

If the activity appears normal, the customer will not even notice the technology at work. In the event of a deviation from the user’s profile, for example, if the system registers unusual keyboard movements or non-standard gestures in the app, additional security measures may be activated.

The tool is particularly useful in scenarios where criminals persuade a customer to install remote-desktop software on their device and then take control of it. Even then, the technology is capable of recognising that the actions being performed do not match the account owner’s unique profile, and it responds appropriately, for example by requesting additional confirmation, sending a notification, or blocking the operation.

Behavioural verification in online banking and mobile apps

Online banking and mobile apps are the areas in which behavioural verification is used most often. It is precisely here that cybercriminals most frequently attempt to gain access to bank accounts, for example through phishing, malware, or the theft of login credentials.

In this context, behavioural verification provides an additional layer of security that protects the user even when someone else has learned their login and password. This is because the system is able to detect that operations are being carried out in a way that differs from normal for example, when the password is entered too slowly or when touchscreen gestures on a smartphone deviate from the standard pattern.

A key strength of this tool is that it increases security without any additional burden on the customer. There is no need to remember extra passwords or enter additional codes.

Effectiveness and benefits for customers

Behavioural verification is one of the most effective tools in the fight against financial fraud. As BIK’s Antifraud Report indicates, more and more financial institutions are implementing such measures in order to increase the security of their customers. The protection provided by BIK’s Behavioural Verification Platform has already been extended over millions of online and mobile banking users, ensuring continuous monitoring for suspicious activity.

For customers, this means:

- a higher level of security the system spots deviations from normal behaviour and blocks suspicious operations before funds are transferred

- protection of confidential data knowing the login and password is not sufficient for a fraudster to gain account access

- usage convenience no need to memorise additional passwords, special characters, or text-message codes

- immediate reaction to threats the bank can notify the user immediately or apply additional security measures

- invisible operation of the technology the customer performs their everyday operations as usual, while the system monitors their consistency with the customer’s behavioural profile

Practice confirms the effectiveness of this approach. According to data from ING Bank Śląski, customers with behavioural verification enabled fell victim to financial fraud up to eight times less often than other users. This shows how introducing this technology significantly reduces the number of unauthorised transactions and raises the level of protection in online banking.

Behavioural verification as part of the BIK ecosystem

One of the leaders in implementing modern anti-fraud technology in Poland is BIK, the Polish credit information bureau. Behavioural verification is an important element in detecting suspicious behaviour. It supports financial institutions in protecting customers from various kinds of fraud.

BIK’s Behavioural Verification Platform is based on advanced machine learning mechanisms that analyse how devices are used by online and mobile-banking customers. The system “learns” the speed at which keys are pressed on the keyboard, characteristic mouse movements, and gestures on the smartphone screen, enabling it to recognise the user’s unique behavioural patterns even more precisely.

Thanks to the central BIK platform, banks can easily add behavioural verification to their services and adjust the level of security measures to their own requirements. If a risk is detected, the system allows additional safeguards to be applied immediately from notifications and requests for additional confirmation to the blocking of operations.

The integration of this technology into the BIK ecosystem means that behavioural verification is not an isolated tool, but part of a broader security strategy that combines diverse mechanisms for data analysis and the monitoring of customer behaviour.

Behavioural verification and the future of security measures

The growing number of cyberattacks and ever more sophisticated methods used to steal data mean that financial institutions have to constantly seek new ways to protect customers. Behavioural verification already constitutes significant support today in preventing fraudulent transactions, but its role will continue to grow.

The directions of development for this technology include:

- the use of artificial intelligence and machine learning algorithms will analyse enormous quantities of data even more effectively and detect anomalies even faster

- ●broader applications beyond banking behavioural verification could protect login processes for online services, provide secure access to public services, and support safer e-commerce transactions

- personalisation of security measures systems will be able to automatically adjust the level of protection to the specific user, taking into account their history of using services and risk level

- integration with other methods of verification for example, combining behavioural biometrics with face recognition or analysis of the device the customer is using

Within the next few years, behavioural verification may become a security standard throughout the financial sector, and then also in other sectors. Its greatest strength remains the fact that it operates discreetly, without hindering the customer’s everyday use of the services, while at the same time ensuring a level of protection level unattainable by traditional methods.

Summary

Behavioural verification is an effective and modern response to the growing threats in the world of cyberfraud. By analysing unique user behaviours, it allows banks to detect attempts to take over accounts before unauthorised transactions occur. For customers it means greater security without additional inconvenience. The solution rolled out by BIK is already significantly reducing the number of fraud cases and is becoming the foundation for future standards of protection in the financial sector.